How to spot fraudulent investment schemes!

Ponzi Scheme

An example of a Ponzi scheme

One well-known example of a Ponzi scheme is the case of Bernard Madoff and his investment firm, Bernard L. Madoff Investment Securities LLC. Madoff orchestrated one of the largest Ponzi schemes in history. He promised consistent, high returns to his clients and attracted substantial investments over several decades.

However, instead of investing the funds as promised, Madoff used the money from new investors to pay returns to earlier investors. The scheme continued for years, and Madoff even created fake account statements to show fabricated profits. Eventually, the fraud unravelled, and in December 2008, Madoff was arrested and later sentenced to 150 years in prison. Thousands of investors lost billions of dollars in the scheme.

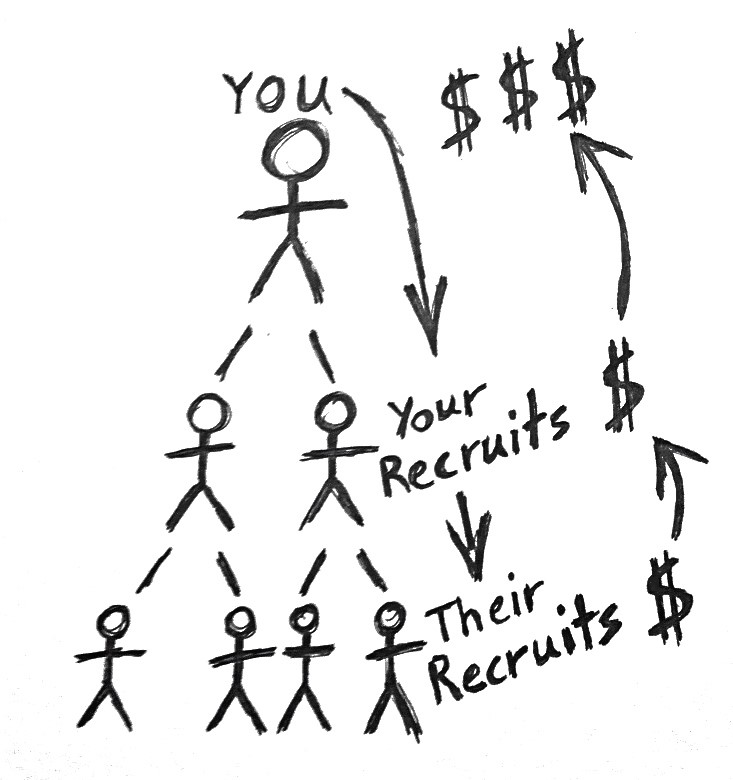

What is a Ponzi Scheme?

A Ponzi scheme is a type of investment scam where the organiser promises high returns to investors but doesn’t actually invest their money. Instead, they use the funds from new investors to pay returns to earlier investors, creating the illusion of profitable investments. The scheme eventually collapses when there aren’t enough new investors to cover the promised returns, causing significant financial losses for those involved. It’s a fraudulent and unsustainable way to generate income.